2023 unemployment tax calculator

Free online income tax calculator to estimate US federal tax refund or owed amount for both salary earners and independent contractors. 370000 20 of the amount exceeding Rs.

Many Employers Face Higher State Unemployment Insurance Tax Costs Due To Covid 19

2022 unemployment tax rate calculator xls 2022 unemployment tax rate table pdf.

. For married individuals filing joint returns and surviving spouses. 075 for 2023 085 for 2024 and 090 for 2025. The tax rate schedules for 2023 will be as follows.

It will be updated with 2023 tax year data as soon the data is available from the IRS. The states SUTA wage base is 7000 per. Employers in California are subject to a SUTA rate between 15 and 62 and new non-construction businesses pay 34.

Once you submit your application we will. Included with all TurboTax Free Edition Deluxe Premier Self-Employed TurboTax Live TurboTax Live Full Service customers and access to up to the prior seven years. You can get tax rate information and a detailed listing of the individuals making up the three-year total of benefit chargebacks used in your Benefit Ratio online or by phone fax.

For Wages Employers Paid in 2021. Calculate Your 2023 Tax Refund. Valid receipt for 2016 tax preparation fees from a tax preparer other than HR Block must be presented prior to completion of initial tax office interview.

The FUTA tax liability is based on 17600 of employee earnings 4900 5700 7000. Where the taxable salary income exceeds Rs. The Federal Unemployment Tax Act FUTA with state unemployment systems provides for payments of unemployment compensation to workers who have lost their jobs.

Take a look at the base period where you received the highest. FUTAs maximum taxable earnings whats called a wage base is 7000 anything an employee earns beyond that amount isnt taxed. In 2022 income up to 147000 is subject to the 124 tax paid for the Social Security portion of self-employment taxes FICA.

3500000 but does not exceed Rs. The standard FUTA tax rate is 6 so your max. The unemployment benefit calculator will provide you with an estimate of your weekly benefit amount which can range from 40 to 450 per week.

2021 Tax Calculator Exit. To calculate your weekly benefits amount you should. Based on the Information you.

Employee 3 has 37100 in eligible FUTA wages but FUTA applies only to the first. Your employment wages and tips should have a 62 deduction. Work out your base period for calculating unemployment.

May not be combined with other. Unemployment insurance FUTA 6 of an. California employers fund regular Unemployment Insurance UI benefits through contributions to the states UI Trust Fund on behalf of each employee.

Calculate your unemployment taxes. Prepare and e-File your. The Unemployment Insurance Fund UIF is a system that gives.

If taxable income is under 22000. Calculate your state local and federal taxes with our free payroll income tax calculator simply choose your state and you are all set. The tax is 10 of.

Return filed in 2023 2021 return filed in 2022. This Tax Calculator will be updated during 2022 and 2023 as new 2023 IRS Tax return data becomes available. 5000000 the rate of income tax is Rs.

This Tax Return and Refund Estimator is currently based on 2022 tax tables.

Llc Tax Calculator Definitive Small Business Tax Estimator

Unemployment Tax Changes Throughout The Country In 2022 First Nonprofit Companies

New York State Enacts Tax Increases In Budget Grant Thornton

Tax Calculators And Forms Current And Previous Tax Years

How Did The Tax Cuts And Jobs Act Change Personal Taxes Tax Policy Center

What Is The Bonus Tax Rate For 2022 Hourly Inc

New Jersey Nj Tax Rate H R Block

2022 Pennsylvania Payroll Tax Rates Abacus Payroll

Simple Tax Refund Calculator Or Determine If You Ll Owe

Many Employers Face Higher State Unemployment Insurance Tax Costs Due To Covid 19

How Do Us Corporate Income Tax Rates And Revenues Compare With Other Countries Tax Policy Center

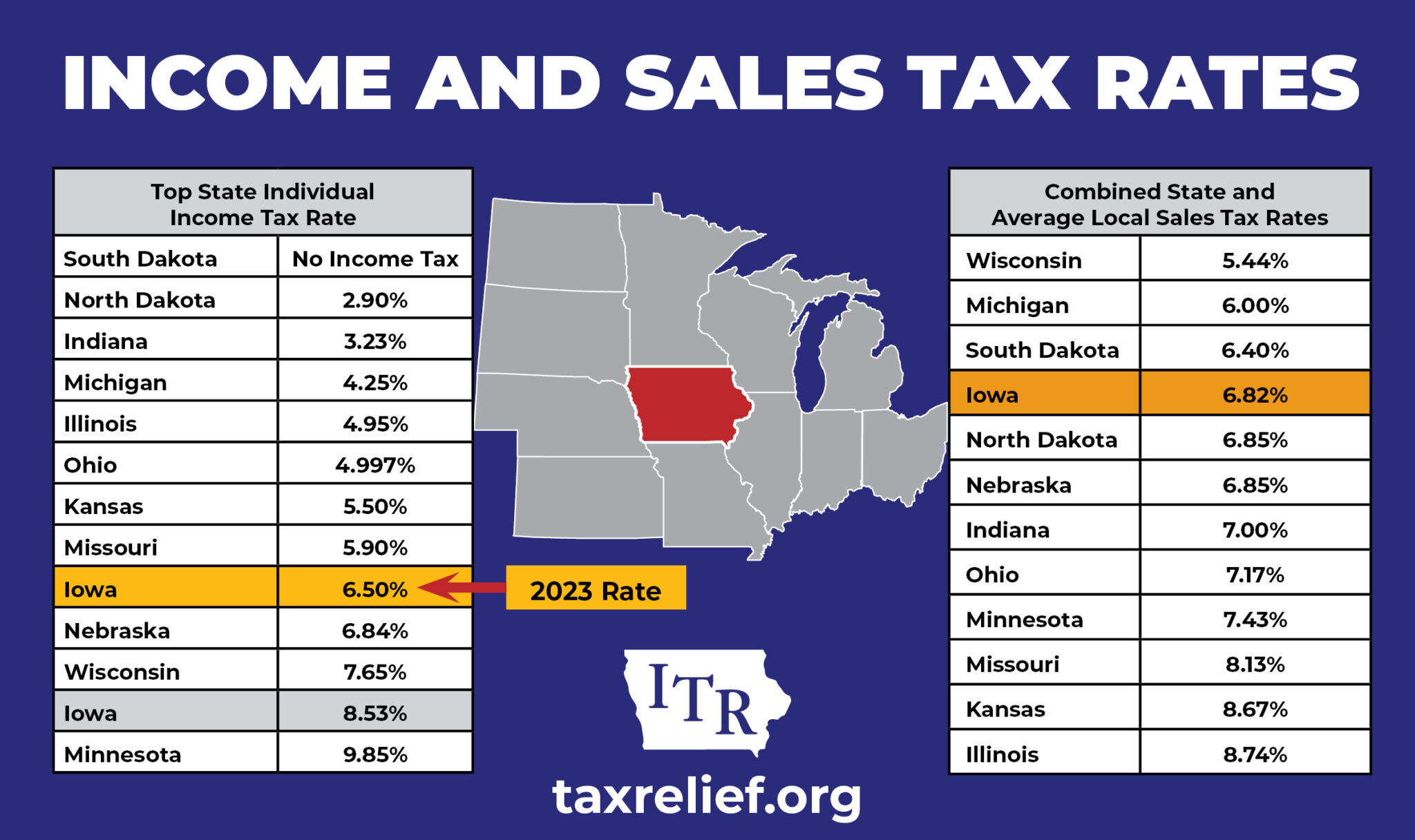

Midwest State Income And Sales Tax Rates Iowans For Tax Relief

2022 Federal State Payroll Tax Rates For Employers

Easiest 2021 Fica Tax Calculator

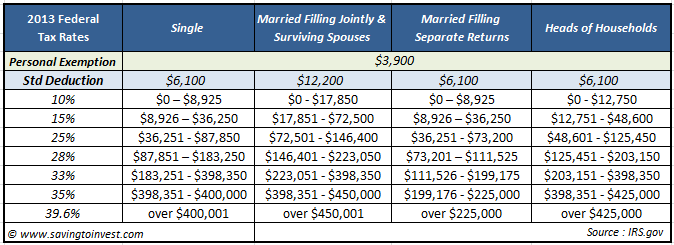

Your 2013 Tax Rate Understanding Your Irs Marginal And Effective Tax Bracket Aving To Invest

2022 Income Tax Brackets And The New Ideal Income

2022 Income Tax Brackets And The New Ideal Income