24+ debt to income mortgage

Apply Easily Get Pre Approved In 24hrs. Ad Were Americas Largest Mortgage Lender.

Student Loan Forecasts For England Methodology Explore Education Statistics Gov Uk

Bank Is One Of The Nations Top Lenders.

. Scroll down the page for more. The ratio is expressed as a percentage and lenders use it to. Web A debt-to-income or DTI ratio is derived by dividing your monthly debt payments by your monthly gross income.

Web To calculate debt-to-income ratio divide your total monthly debt obligations including rent or mortgage student loan payments auto loan payments and credit card. Find The Right Mortgage For You By Shopping Multiple Lenders. They called the other day and said the underwriter didnt like my debt to income ratio and would either need to add my wife to.

Apply Online Get Pre-Approved Today. Find The Right Mortgage For You By Shopping Multiple Lenders. If we look at the.

Easily Compare Mortgage Rates and Find a Great Lender. What More Could You Need. Expert says paying off your mortgage might not be in your best financial interest.

Calculating your DTI may help you determine how comfortable. Web My debt to income was only 24. Web Usable income depends on how you get paid and whether you are salaried or self-employed.

Web The 3545 Rule. Web If youd put 10 down on a 555555 home your mortgage would be about 500000. Ad Get 3 alternative investments with higher yields that could make your mortgage free.

Ad Compare Best Mortgage Lenders 2023. In that case NerdWallet recommends an annual pretax income of at least 184656. Web 18 hours agoYour debt-to-income ratio DTI includes your mortgage maintenance or taxes and any other long-term debt including credit cards auto payments and other.

Lets look at an example to make this clearer. To calculate his DTI add up his monthly debt and mortgage payments 1600 and divide it by his gross monthly income. Lowest Home Financing Rates Compared Reviewed.

Easily Compare Mortgage Rates and Find a Great Lender. Web For example say that your total monthly obligations add up to 2000 when taking into account all your minimum payments and your new mortgage -- and say your. Web Your monthly debts include 1000 for rent a 400 car payment a 250 student loan payment and three credit cards youre paying off with 35 minimums each.

Web The Federal Housing Finance Agency has pushed back the implementation date of some of the adjusted fees set to apply to mortgages purchased by Fannie Mae. Web Before taxes Bob brings home 5000 a month. It Pays To Compare Offers.

Lock Your Mortgage Rate Today. Web Debt-to-income ratio DTI shows a persons monthly debt obligations as a percentage of their gross monthly income. Ideally lenders prefer a debt-to-income ratio lower.

If you have a salary of 72000 per year then your usable income for. Web As a general guideline 43 is the highest DTI ratio a borrower can have and still get qualified for a mortgage. Web In January 2023 FHFA announced redesigned and recalibrated grids for upfront fees in addition to a new upfront fee for certain borrowers with a debt-to-income.

What More Could You Need. Ad Were Americas Largest Mortgage Lender. Ad Highest Satisfaction For Home Financing Origination.

Bank We Offer Tools Resources For Navigating Home Loans From Start To Finish. Ad First Time Home Buyer. Web In addition to your credit score your debt-to-income DTI ratio is an important part of your overall financial health.

Web The total of your monthly debt payments divided by your gross monthly income which is shown as a percentage. It Pays To Compare Offers. Apply Today Enjoy Great Terms.

The 3545 rule emphasizes that the borrowers total monthly debt shouldnt exceed more than 35 of their pretax income and also shouldnt. Ad First Time Home Buyer. For example if your monthly pre-tax income.

Lock Your Mortgage Rate Today. Your DTI is one way lenders measure your ability to manage. It Only Takes 3 Minutes To Get a Rate 25 Days To Close a Loan.

Web According to Investopedia in general you and mortgage lenders do not want a total debt-to-income-ratio over 36. Web The calculator works immediately as you slide or input your gross monthly income monthly debts loan terms interest rate and down payment. Web You can calculate it by adding up your monthly housing expenses such as mortgage and insurance payments dividing the total by your gross monthly income and.

17 Best Personal Loan Lenders Loans In As Little As 24 Hrs

Mortgage Income Requirements In 2015 Influenced By Government Rules

Fha Requirements Debt Guidelines

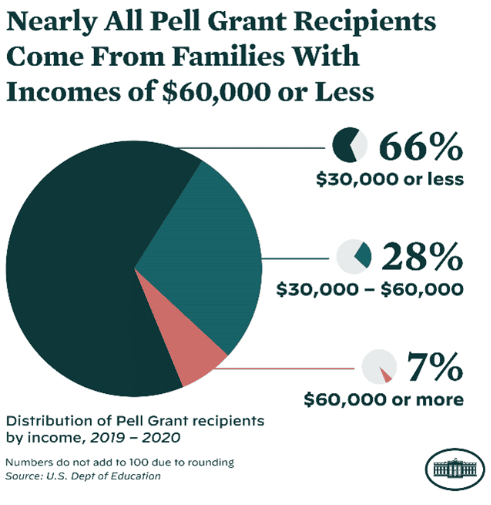

3 Take Aways That Optometrists Should Know About Biden S Student Loan Debt Relief Ods On Finance

Student Loan Forecasts For England Methodology Explore Education Statistics Gov Uk

Debt To Income Ratio Calculator What Is My Dti Zillow

How Debt To Income Ratio Dti Affects Mortgages

What You Should Know About Debt To Income Ratios

North N Loans Reviews Ratings And Fees 2023 Loans Canada

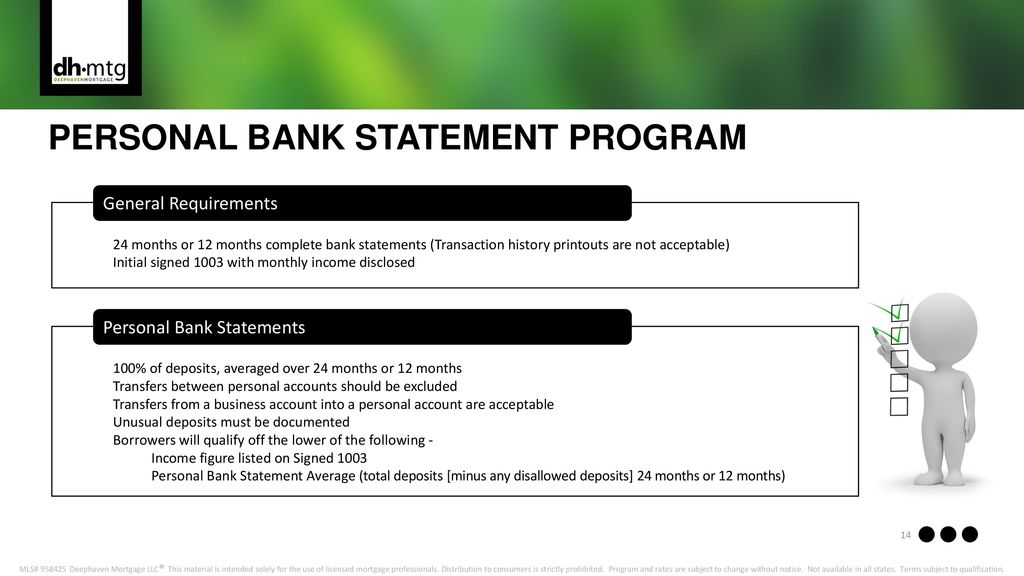

Delegated Underwriting Training Ppt Download

Debt To Income Ratio Loan Pronto

Debt To Income Ratio Calculator For Mortgage Approval Dti Calculator

Kemper Corporation Prices Baby Bonds Innovative Income Investor

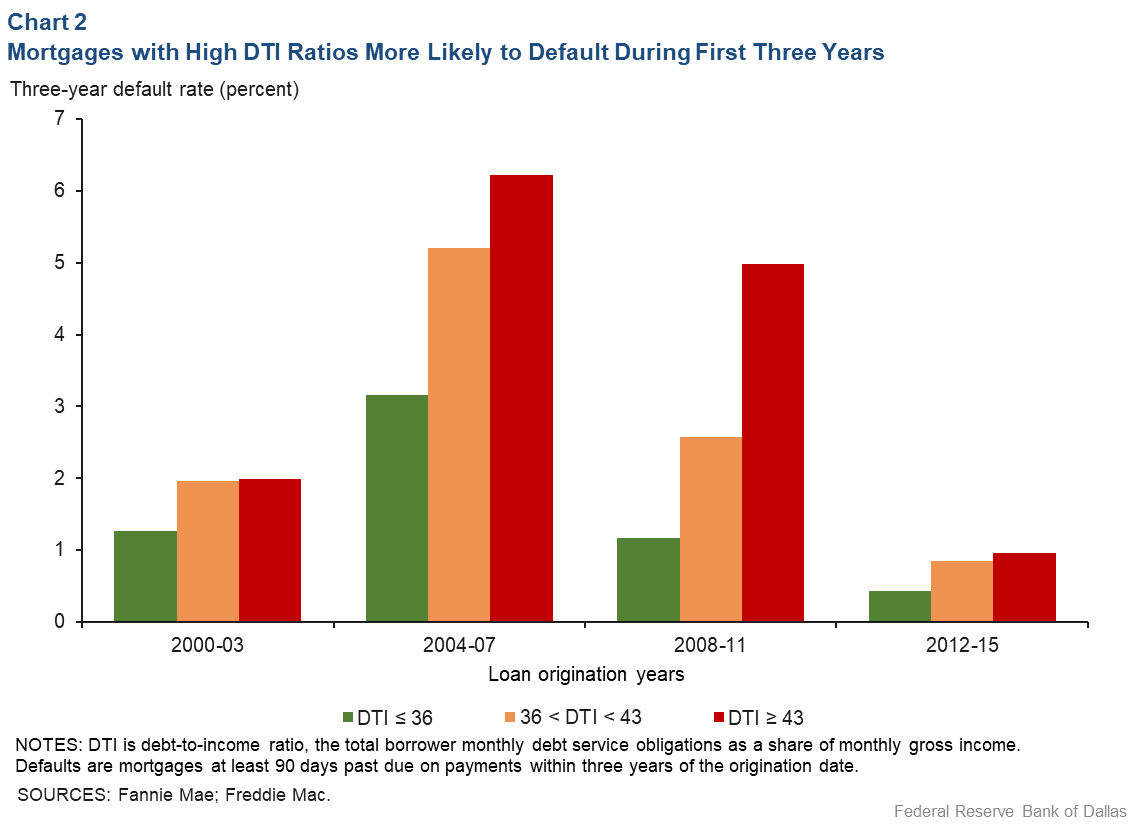

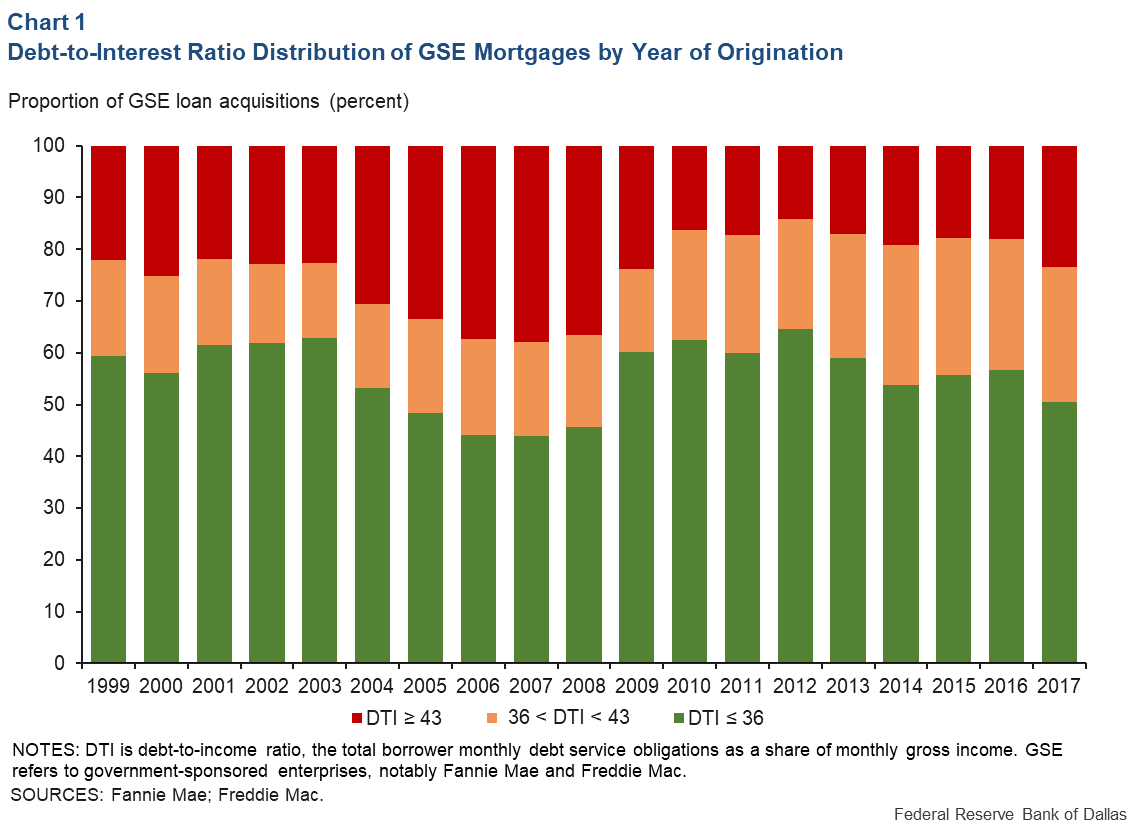

Ability To Repay A Mortgage Assessing The Relationship Between Default Debt To Income Dallasfed Org

Ability To Repay A Mortgage Assessing The Relationship Between Default Debt To Income Dallasfed Org

What Is The Debt To Income Ratio Learn More Citizens Bank

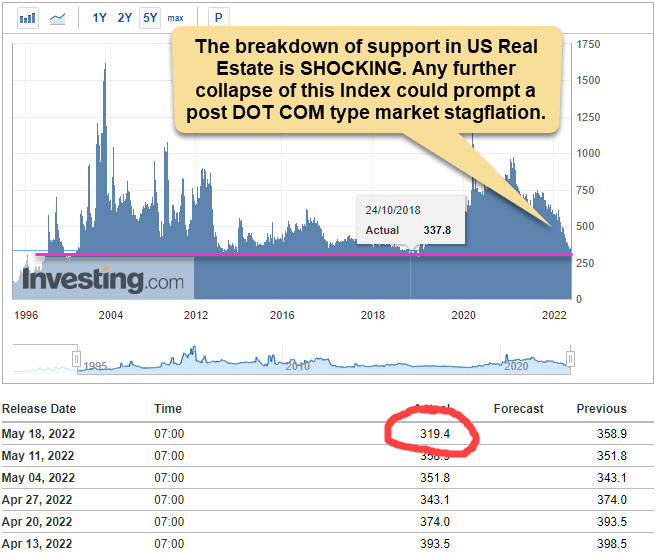

Real Estate Investors Is There An End In Sight Mining Stock Education